japan corporate tax rate 2017

Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of 334 Table 3-5 applies. Asia has the lowest regional average rate at 1962 percent while Africa has the highest regional average statutory rate at 2797 percent.

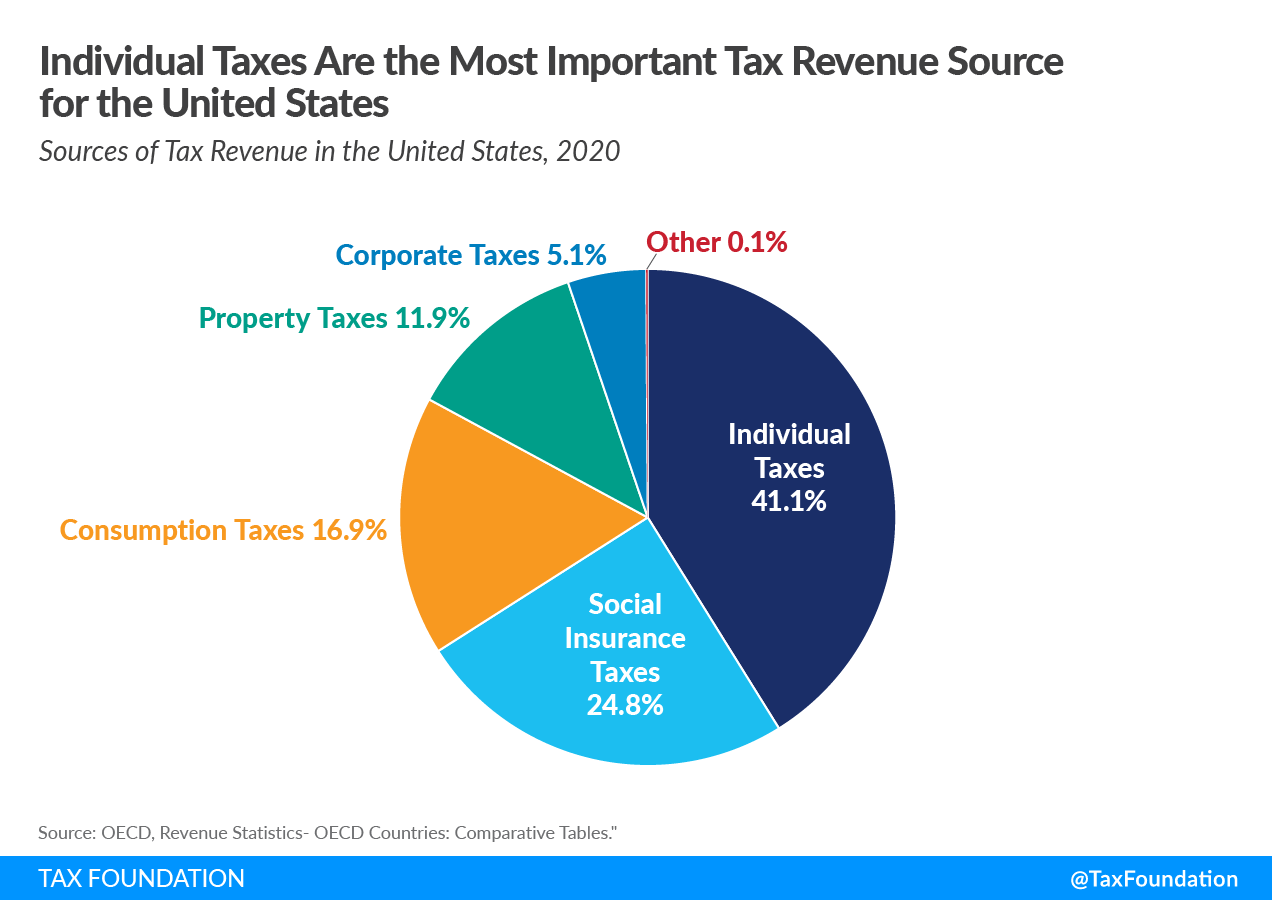

Sources Of Us Tax Revenue By Tax Type 2022 Tax Foundation

National Income Tax Rates.

. The second post of this series explains how the Controlled Foreign Corporation CFC rules work in Japan. However the WHT rate cannot exceed 2042 including the income surtax of 21 on any royalties to be received by a non-resident taxpayer of Japan under Japanese income tax law. Japan also slowly decreased its.

The government initially planned to reduce the rate to below 30 percent in fiscal 2017 after cutting it. The federal corporate income tax was fist implemented in 1909 when the uniform rate was 1 for all business income above 5000. Japan had a worldwide tax system until 2009.

227 rows The worldwide average statutory corporate income tax rate measured across 180 jurisdictions is 2354 percent. Global minimum corporate tax rate. Since then the rate peaked at 528 in 1969.

Total of GDP. 33 098 Total US dollarscapita 2020 Japan US dollarscapita. Tax rates for fiscal year filers.

In 2017 Japan amended its CFC legislation to adjust the rules with some of the recommendations provided in the OECD BEPS project. Corporate Tax Rates 2022 includes information on statutory national and local corporate income tax rates applicable to companies and branches as well as any applicable branch tax imposed in addition to the corporate income tax eg branch profits tax or branch remittance tax. Total Thousand toe 1998-2017 Japan red Total Thousand toe 2017.

Corporate Tax Rates 2022. At present Japans corporate tax rate is 3211 percent. Taxable Income Tax Rate less than 195 million yen 5 of taxable income 195 to 33 million yen 10 of taxable income minus 97500 yen 33 to 695 million yen 20 of taxable income minus 427500 yen 695 to 9 million yen 23 of taxable income minus 636000 yen 9 to 18 million yen.

Effective Corporate Tax Rates With Uniform and Country-Specific Rates of Inflation in G20 Countries 2012 37 Figure B-4. The Revenue Reconciliation Act of 1993 increased the maximum corporate tax rate to 35 for corporations with taxable income over 10 million. Initially until April 2017 and then October 2019.

Effective Corporate Tax Rates With Alternative Allocations of Asset Shares in G20 Countries 2012 34 Figure B-2. The tax treaty with Brazil provides a 25 tax rate for certain royalties trademark. Effective Corporate Tax Rates With Alternative Rates of Inflation in G20 Countries 2012 35 Figure B-3.

As a result the top US corporate tax rate including the average state corporate rate is now lower than that of all other leading economies in the G7 except. 1 2018 the corporate tax rate was changed from a tiered structure that staggered corporate tax rates based on company income to a flat rate of 21 for all companies. 115-97 replaced the graduated corporate tax structure with a flat 21 corporate tax rate and repealed the corporate alternative minimum tax AMT effective for tax years beginning after December 31 2017.

In the world as of 2017to 21 in 2018. Japan red Tax on corporate profits Indicator. Film royalties are taxed at 15.

Annual growth rate 2020 Japan red Net national income Indicator. 2017 Japan Thousand toe. Shortly after the tax was introduced Japan fell into recession.

However under section 15 corporations with fiscal tax years beginning before January 1 2018 and. 115-97 replaced the graduated corporate tax structure with a flat 21 corporate tax rate. The 2017 Tax Cut and Jobs Act TCJA reduced the top US corporate tax rate from 35 percent to 21 percent and the average combined federal and state rate from 389 percent to 259 percent.

The United Arab Emirates has the worlds highest corporate tax rate and several Caribbean nations have the lowest. CFC rules were incorporated by Japanese legislation in 1978. The government lowered the corporate tax rate from 3211 percent to 2997 percent for this fiscal year to March while the Bank of Japan has been committed to the ultraloose monetary policy that.

31 Total of GDP 2020 Japan of GDP. 332 Corporate income taxes and tax rates The taxes levied in Japan on income generated by the activities of a corporation include corporate tax. When weighted by GDP the average statutory rate is 2544 percent.

For tax years beginning after 2017 the Tax Cuts and Jobs Act PL.

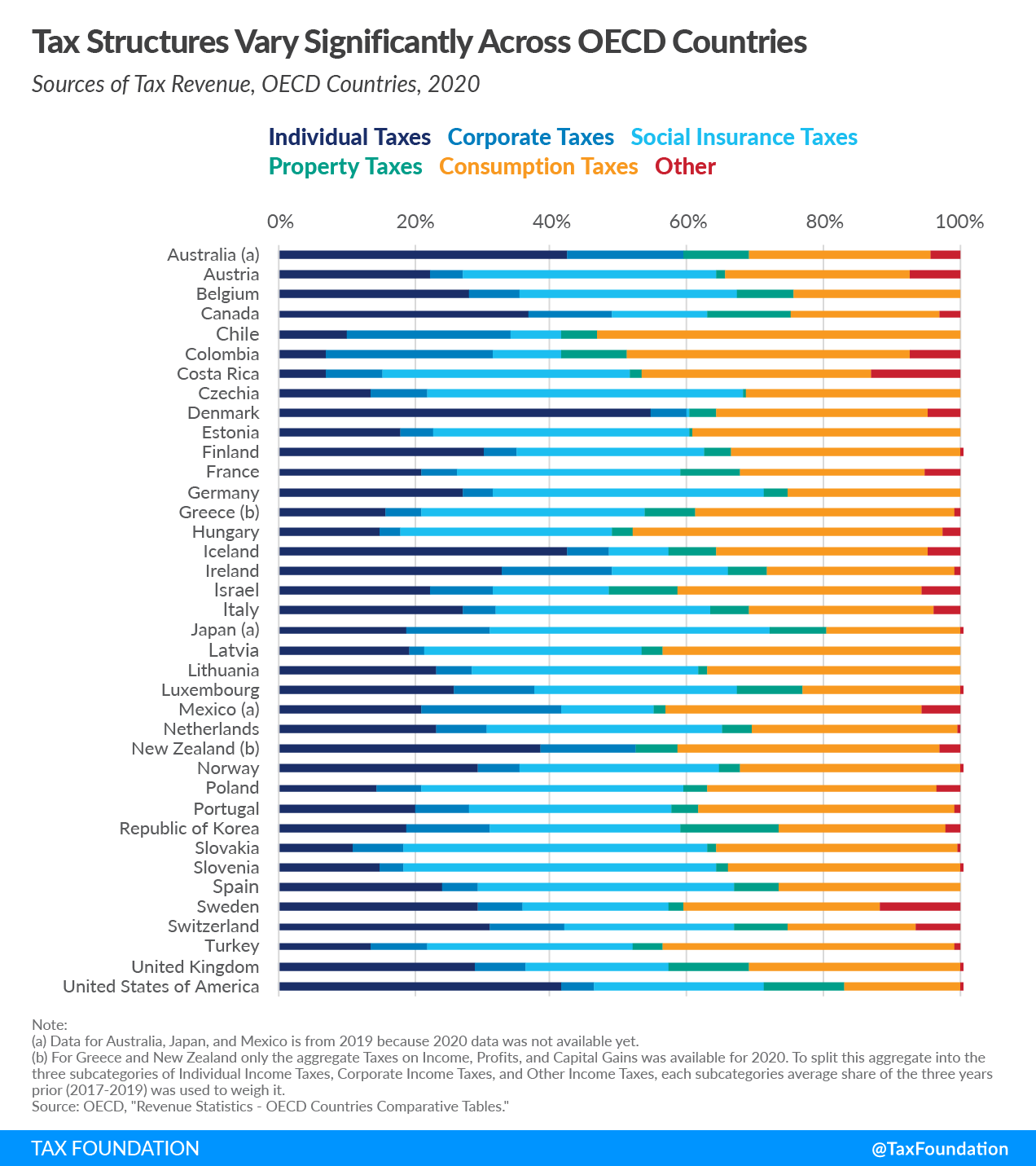

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Japan Share Of Smoking Adults Statista

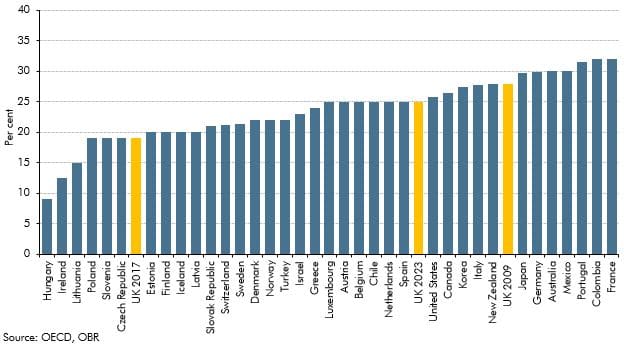

Corporation Tax In Historical And International Context Office For Budget Responsibility

Canada Tax Income Taxes In Canada Tax Foundation

Switzerland Tax Income Taxes In Switzerland Tax Foundation

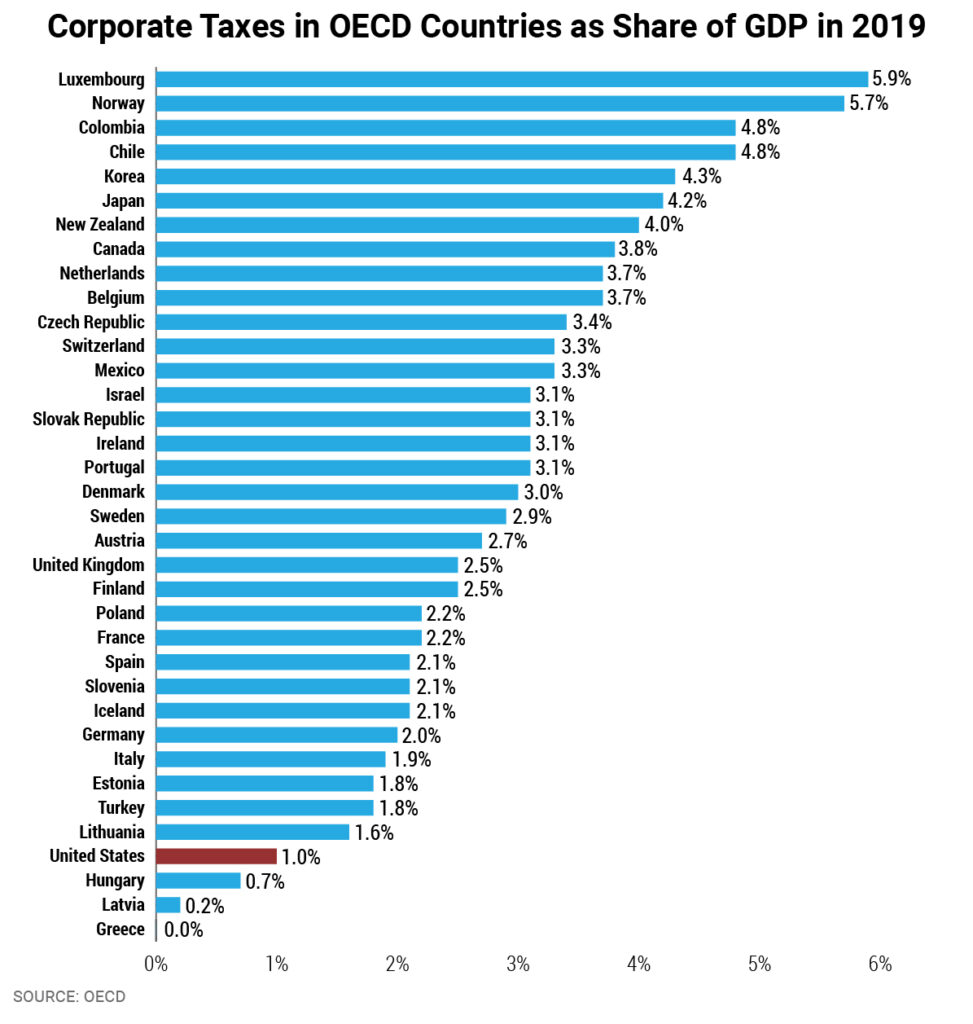

Corporate Tax Reform In The Wake Of The Pandemic Itep

Switzerland Tax Income Taxes In Switzerland Tax Foundation

Corporation Tax Europe 2021 Statista

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

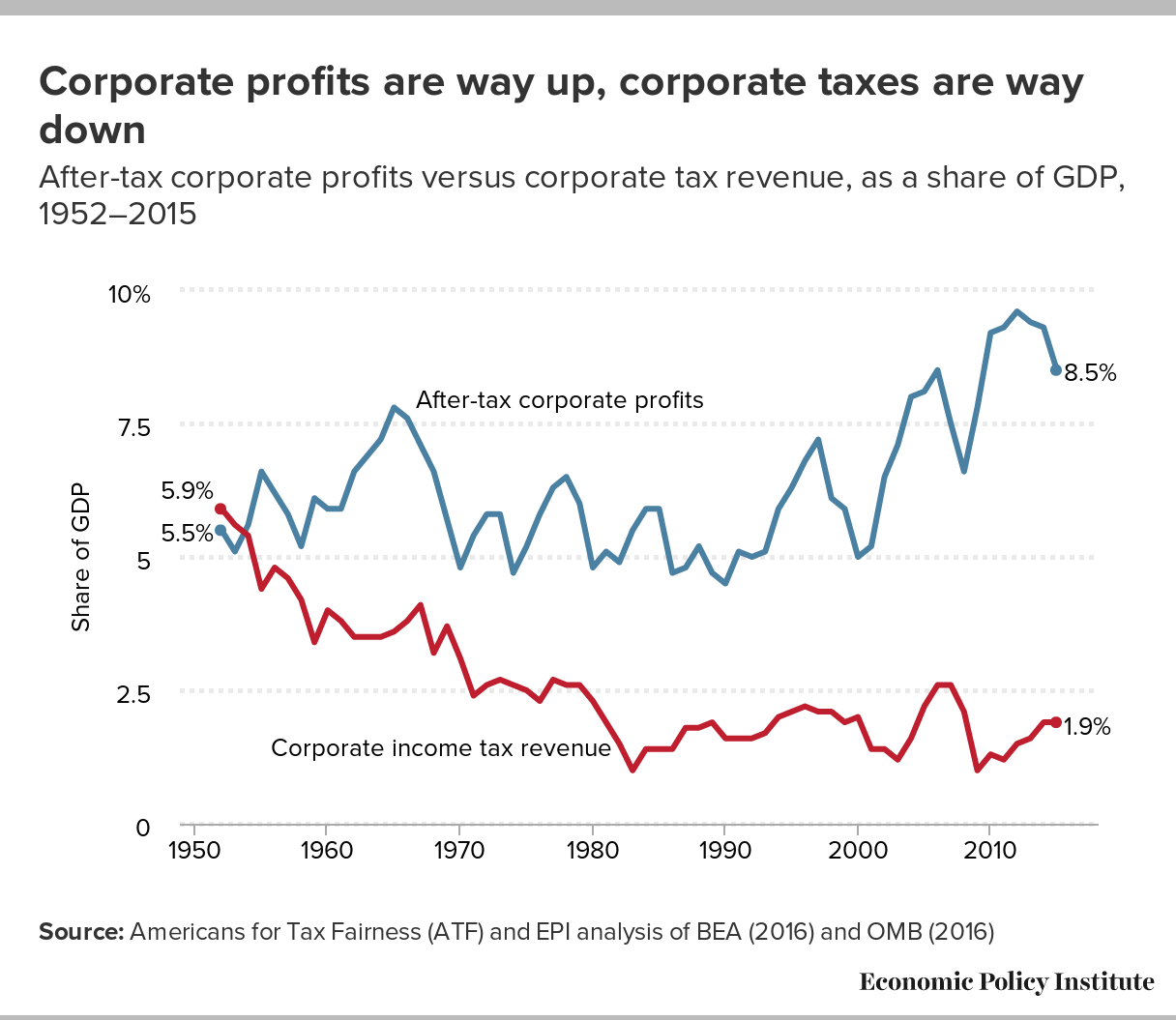

Competitive Distractions Cutting Corporate Tax Rates Will Not Create Jobs Or Boost Incomes For The Vast Majority Of American Families Economic Policy Institute

3 7 Overview Of Individual Tax System Section 3 Taxes In Japan Setting Up Business Investing In Japan Japan External Trade Organization Jetro

Corporate Profit Shifting And The Role Of Tax Havens Evidence From German Country By Country Reporting Data Eutax

Corporate Tax Reform In The Wake Of The Pandemic Itep

Doing Business In The United States Federal Tax Issues Pwc

Corporate Income Tax Cit Rates

Competitive Distractions Cutting Corporate Tax Rates Will Not Create Jobs Or Boost Incomes For The Vast Majority Of American Families Economic Policy Institute